In 2002, the law firm for which I worked was involved in the Dollar General debacle, helping clean up the mess after the company restated financial statements due to massive accounting fraud. I didn’t know much about Dollar General at the time. But I do remember that a firm partner told me that one of the company’s directors had succinctly described their business model to him. “We sell shit, to poor people.” Cal Turner, Jr., has written this book to explain that business model and his part in it.

In 2002, the law firm for which I worked was involved in the Dollar General debacle, helping clean up the mess after the company restated financial statements due to massive accounting fraud. I didn’t know much about Dollar General at the time. But I do remember that a firm partner told me that one of the company’s directors had succinctly described their business model to him. “We sell shit, to poor people.” Cal Turner, Jr., has written this book to explain that business model and his part in it.

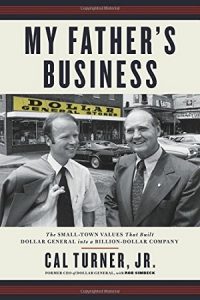

My Father’s Business has three threads. It is a history of Dollar General as a small, scrappy business. Then it is a history of Dollar General as big business. And intertwined throughout are elements of religious tract (the title is a play on words, the relevant “father” being both God and Cal Turner, Jr.’s own father, the original Cal Turner). Actually, despite the title, the religious elements are fairly light—Turner is a devout Methodist, a group not given to aggressive evangelization. But to his credit, he is not apologetic about the importance of his religious belief, something refreshing in today’s publishing environment. I’m a bit put off by some instances of how he applies his faith, but as Pope Francis says, who am I to judge?

It’s the early history of Dollar General that interested me most, since my own post-law background is as entrepreneur. Most books about entrepreneurship are totally clueless, or a pack of lies. Charles Koch’s Good Profit, for example, is an awful, worthless book. Peter Thiel’s Zero to One, with its focus on monopoly and reek of private equity money, has nothing to do with the gutter struggles of real entrepreneurs, the type that made America. Turner experienced that gutter struggle firsthand—really, his grandfather and his father more than him, but the business was still quite small when he started working at Dollar General, in the early 1950s. While my experience is in manufacturing, and Turner’s in distribution and sales, many of the same challenges arise, and they are not challenges understood by anyone who has not run a business on a shoestring. Turner, or rather his father, did, and Turner does a good job of conveying what that’s like, with anecdotes both amusing and heartbreaking, such as his father spending every Saturday night for many years calling every store manager to figure out what cash he would get the following week, so he could decide which vendors’ bills to pay.

In fact, cash flow is the single biggest concern for any real entrepreneur, and stores that keep inventory, like Dollar General, tend to face the most challenges. As a result, real entrepreneurs are always worried about bankruptcy, which can happen even if a business is profitable. Cal Turner, Sr., used to half-joke when he got a good buy on some goods that “If I have to declare bankruptcy, I won’t be embarrassed to tell the judge what I paid for this inventory I can’t get rid of.” Similarly, Turner mentions that his grandfather, Luther Turner, “bought a farm and put it in [his wife’s] name so that if the company went under, all of them could return to the land and start over.” For years I kept all my assets in my wife’s name for the same reason—so I could collapse our business and we would not be left destitute, but could begin again. To this day, my thoughts revolve around the need to prepare for that possibility. This sort of thing, necessary because of the enormous risks, is the norm among entrepreneurs. Nor do most people realize that entrepreneurs can’t borrow money like you read about in the news. If they can get a loan at all, entrepreneurs pay high interest rates where big companies pay zero interest rates, thanks to the government, and the entrepreneur also has to personally guarantee the loan, so he’ll be personally ruined if the company can’t pay.

But most other people, working eight-hour days, simply don’t understand any of this, the risks and the amount of work and sacrifice required, at any level. Nor, of course, do politicians, like Elizabeth Warren with her infamous “you didn’t build that” screed. She, like probably 98% of the people in Congress, has never built anything, or taken any material risk, in her entire life. Reading this short book would be a good requirement for any politician before taking office. The simple fact is that a very small group of people are the producers of most of the economic value in a society; without them, that is, without their drive and organization, output would be vastly lower. That’s one thing Ayn Rand got right, and when you read Marxists claiming that workers can run their own factories, you know you are reading someone with no actual experience of business.

Cash problems went away pretty early in his career for Cal Turner, however, since the company went public in 1963. From this point on the book was less interesting to me; it became a chronicle of ever larger acquisitions, along with discussion of family troubles, as Turner, by his account, just had to get rid of his father (right after his mother died), as well as his brother, and leave himself in charge. No choice in the matter, you see. Jesus told him to do it, in fact, when He said that every branch that doesn’t bear fruit should be pruned. Maybe so, but I’d be curious for some Rashomon-type viewpoints. Turner also seems addicted to “management training” and “strategic planning” which I think is dubious in most cases, along with “individual value statements,” which are dubious in all cases. (I could never understand at business school why people who had never run a business were not only allowed to teach “strategy,” but were held in great respect.) On the other hand, Turner was by the 1970s running a very large company, quite far-flung, so perhaps external training was helpful to weld people together into common action.

In many places, Turner describes a number of completely illegal practices under the securities laws that the company engaged in, including overt lying over decades. Yet he claims he was completely shocked when in 2002 it turned out that due to his complicity and negligence (not that he admits it), the company’s books were fraudulent and he was forced out—really, fired. Nor does Turner mention that in 2005 the SEC sued him and four other officers for accounting fraud, and he personally paid a fine of a million dollars. Instead, he complains “Everybody seemed to have a stake in making us look bad. The process was terribly injurious and punitive, and a lot of people were getting hurt.” He moans about how unfair it was that someone could accuse a “values-based leader” like himself of, gasp, “cooking the books.” (He also talks about his “time in the barrel at the SEC”; I don’t think he, or rather his ghostwriter, looked up the origin of that metaphor.) It’s tiresome and lacks any sense of humility.

Turner could afford the fine. He’s a billionaire, not that he mentions that in the book either. (He does seem to leave out quite a few things in which the reader would be interested; I’m sure there’s more that I’m just not catching.) Nor does he mention the ancient Christian question of the salvation of the rich. This is a question that concerns me, though. Between Christ’s injunction to the rich young man to sell all that he had and give it to the poor, and the admonition about rich men, camels, and needle’s eyes, I should probably lie awake at night. On the other hand, my fallback position is that of Zacchaeus the publican. After all, he got direct approval from Jesus to only give away 50%, and he was an actual fraudster, so I figure 50% is a ceiling, not a floor. Between that and pointing to my wife and saying “I’m with her,” I hope to still gain admittance from Saint Peter. Wish me luck!

Anyway, my guess is that the primary reason Turner wrote this book is that he, and the rest of his family, have been mostly erased from history by today’s Dollar General. If you go to the Wikipedia entry for the company, it’s all about boring details after Turner’s firing. He, his father, and grandfather, only get a few sentences. After 2002, the company was soon turned into an arm of private equity (then eventually went public again), and their PR firm doubtless scrubbed the entry. Wikipedia most definitely does not mention any part of the episode that got Turner fired.

But despite Turner’s best efforts to put a shiny gloss on Dollar General’s business, it still has the slightly dirty feel of all businesses that fall somewhere along the line between catering to, and taking advantage of, the poor. Dollar stores are, after all, the same basic type of business as pawnbrokers and payday lenders. On the other hand, Dollar General today, and throughout its history, does seem to be remarkably free of leftist cant—you can’t find any on their current website, and Turner certainly offers none. That’s a rare treat today in the age of social justice warrior corporations. And aside from serving areas that often lack stores (although I am curious if the company, like WalMart, also pushes aside existing local business), the company has for decades offered the real service of upward mobility, since anyone competent can climb the corporate ladder. True, I don’t think Dollar General is especially Jesus-approved, as Cal Turner would have it, but it’s a decent business that provides value to the poor in consumer goods and jobs. That is a niche that has been very good to Cal Turner, and, also, for the most part, been a boon to many poor areas of America. On balance, Cal Turner should be proud of his life, and if you like this type of book, his story is worth reading.